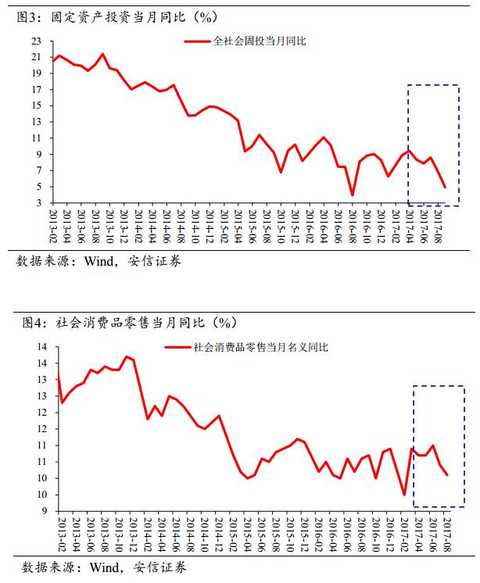

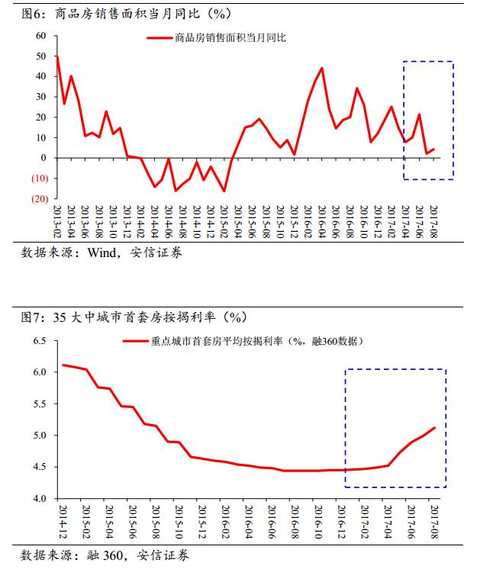

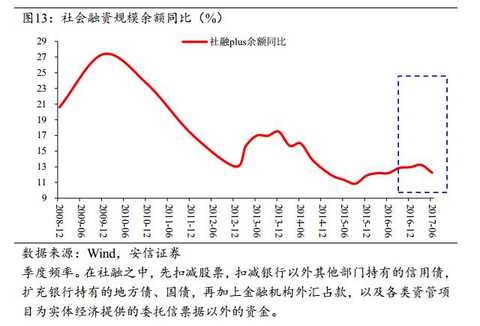

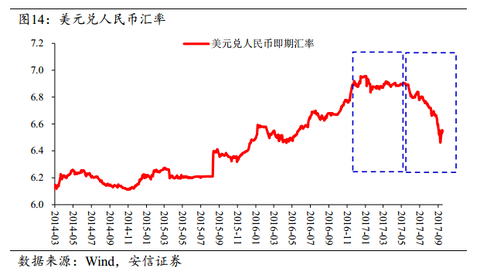

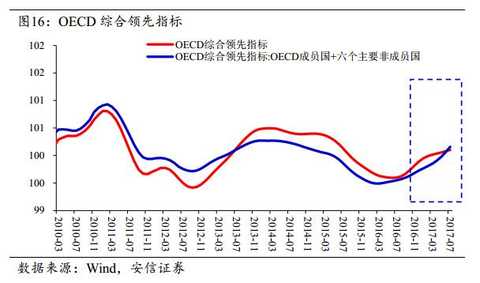

Source WeChat public number: Chief Economist Forum public number The author of this article is An Xin Securities Gao Shanwen, Yao Xuekang Gao Shanwen is the chief economist of Essence Securities and a member of the China Chief Economist Forum In January and August, the supply of limited quantities fell. In August, the increase was 6% year-on-year, down 0.4 percentage points from July. It was lower than the market consensus. Mining and utilities were mainly dragged down, and manufacturing growth was generally flat. The PPI for the month was 0.9%, which was 0.7 percentage points higher than that in July, which was significantly higher than market expectations. In terms of volume, since July-August, raw coal, coke, cement, glass, non-ferrous metals and other fields have experienced a decline in output and a strong price increase. The weakening of expectations and the stronger-than-expected prices clearly show that although demand-side forces are equally present and critical, the consolidation of supply forces seems to have the upper hand in all industrial consolidations. This is similar to the situation in the second half of last year. In the medium term, the contraction in supply in the industrial sector is closely related to the continued slowdown in investment over the past few years, the slowdown in current and future capacity launches, and the increase in industry concentration. However, in the short to medium term, factors such as the continued deepening of supply-side reforms in some industries, the fourth batch of environmental protection inspections, and the strengthening of air pollution in Beijing, Tianjin and Hebei may be even more critical. Especially in this, the influence of environmental factors cannot be ignored. In the future, if the power to restrict supply is weakened, for example, more enterprises meet environmental protection requirements, then under the assumption that the demand side is generally stable, we may also see the increase in volume and the fall in prices. Discussion 1: Environmental protection not only affects upstream production, but also affects downstream construction. In fact, it should also be noted that environmental protection supervision has an impact on downstream construction activities while aggravating production shrinkage. For example, the slippage of fixed-asset investment in July-August, in addition to disturbances in hot weather, may also be related to environmental protection to some extent. How to grasp the balance between environmental protection and economy and employment has become a hot topic in some aspects. For another example, statistically, the retail of social consumer goods includes both the purchase of goods by the resident departments and the purchase of investment products by the corporate sector. Therefore, its continuous downward trend from July to August does not rule out the same as the fixed asset investment data, which is dragged down by environmental factors. Whether it is restricting upstream production or dragging down downstream construction, the impact of environmental protection on industrial product output is negative. But is its impact on industrial prices up or down? Considering that the upstream production is relatively concentrated and the downstream construction is more dispersed, in theory, it should mainly promote the price of related raw materials. Discussion 2: Deviation between daily consumption of coastal power plants and industrial growth rate In August, the coal consumption of coastal power plants remained high, and the year-on-year growth rate further increased. This is considered to be the main reason for the continued rise in thermal coal prices during the period, and may also lead the market to optimistic expectations for industrial growth in the month. However, the latest data on power generation, thermal power generation, and industrial growth rate are all deviated from the direction of coal consumption in coastal power plants. This first shows that the main supporting factor of recent thermal coal prices does not seem to be terminal demand such as economic output and thermal power generation growth, but the contraction of the production end and the stock hoarding demand of some intermediate links in this context. In addition, the reason for the deviation between the daily consumption of coastal power plants and economic activities is theoretically clear. First, the coal consumption of coastal power plants currently tracked accounts for a slight proportion of the power coal consumption in the power industry at 10%, and its representativeness is questionable. For example, the continuity between coal consumption in coastal power plants and the regional economy should be closer. When the regional economy and the national economic trend are inconsistent, it will deviate from the national thermal power and national economic kinetic energy. Second, due to the advancement of supply-side reforms, the supply of thermal coal has returned to a shortage, and the proportion of Changxie coal has risen again since the end of last year. Due to the existence of the long-term power plant, the supply of thermal coal is relatively easy to be guaranteed, which helps its market share to rise, resulting in the deviation of the daily consumption of coastal power plants from the national thermal power and national economic kinetic energy. This factor may be dominant in the near future. Third, in recent years, the regulation and rectification of self-provided power plants has increased, and the demand for electricity in the real economy has shifted more to power generation companies. In this context, even if the daily consumption of coastal power plants is consistent with the national power generation, it may be contrary to GDP and industrial growth. Since the second half of 2016, the economic growth rate has been generally stable, but the power generation has continued to rise sharply, which may be affected by self-supplied electricity. Second, the risk of insufficient color in the peak season needs to be carefully evaluated From the end of last year to the first half of this year, the economy has experienced a certain degree of "low season is not light, the peak season is not prosperous", from June to August, the off-season does not fade, this can not help but worry, will it be the next season? Wang? First of all, in the real estate market, the cooling trend of sales activities has gradually become clear. In August, the sales of commercial housing in the country was 4.3% year-on-year, the lowest monthly level since the second quarter of 2015. Micro-data feedback, August 35 The mortgage rate of the first suite in large and medium-sized cities further increased, and the mortgage release time was lengthened. This continued to inhibit the sales activities of large and medium-sized cities and may spread to the third- and fourth-tier regions. Due to the significant de-consumption of inventory, the cooling of commercial housing sales activities may be significantly weaker than the development of investment activities, and in the near term, the performance of investment and land acquisition will be strong. But its marginal impact on mood and expectations, the future still needs attention. Secondly, the export growth rate has weakened in July-August. From the perspective of cement production, domestic investment demand this year is slightly weaker than last year. However, the overall economic momentum can still maintain general stability. The most important force is the continued recovery of exports from the second half of last year to the first half of this year. China's export growth has slowed down in the past two months. We tend to think that it is a temporary disturbance. The possibility of continuing the downward trend may not be high. This requires further observation. In addition to fixed asset investment, consumption and exports, the impact of inventory willingness on short-term economic dynamism is critical. This round of inventory replenishment process since June has lasted for nearly 3 months. Will it gradually become exhausted and go to the opposite side? In spite of the supply contraction, the absolute level of inventory in each link is not high, but its marginal changes and dragging effects still need to be closely tracked. Product price is an important synchronous indicator of inventory behavior. At the spot level, the prices of production materials in the circulation sector continued to rise in the first half of September, and reached a new high in the year. In terms of details, the growth rate of oil and gas, chemicals, coal and paper products continued to expand; the growth of non-ferrous and black products eased. However, higher-frequency futures data shows that the South China Industrial Products Index has declined since September, and the follow-up trend needs to continue to pay attention. In general, we tend to believe that the real economy will continue to operate for a period of time in the "L"-shaped horizontal position, during which jagged ups and downs may be difficult to avoid. In the short-term, demand has weakened. The high-margin stimulation of supply, the possibility of falling industrial prices and gross profit margins are high. At that time, debt market investors may also be worried about the rise in PPI caused by CPI inflation. Stock market-related sectors will also adjust due to the decline in gross profit, but the trend of industry turnover and concentration, as well as the improvement of the medium and long-term economic outlook, continue to provide critical support to the equity market. Third, the growth rate of money and credit continues to expand, and the direction of financial de-leverage remains unchanged. In August, M2 was 8.9% year-on-year, down 0.3 percentage points from the previous month. It was also the lowest level in many years. M1 was down 14% year-on-year, down 1.3 percentage points. The decline of M2 and the rising cost of holding up demand deposits jointly promoted its growth rate. Continue to fall. While M2 continued to decline year on year, the scale of loans and social financing was generally stable. New loans for the month were 1.09 trillion, which was significantly better than the same period last year. The balance was 13.2% year-on-year, unchanged from the previous month. In terms of the details, the resident mortgages remained at a high level, the medium and long-term loans of the enterprises were strong, and the provision of short-term loans and short-term loans rebounded. The newly added social financing scale of the month was 1.48 trillion yuan, and the balance was 12.6% year-on-year, a slight decrease of 0.1 percentage points from the previous month. At the same time as the loan improved, the entrusted loans continued to be sluggish, and corporate bond financing shrank from last month, and no improvement was made. If we further consider local debt, national debt and foreign exchange, the wide-ranging social balance will be 11.7% year-on-year, a slight decrease of 0.2 percentage points. The further expansion of the growth rate of money and credit shows that the process of financial deleveraging and capital “de-virtualization†continues. Discussion 3: The impact of financial deleveraging on the real economy The “money shortage†in 2013 has led to a rise in broad-spectrum interest rates in the financial market and a decline in social financing, which is one of the key factors for the subsequent sharp decline in aggregate demand over expectations, or at least an important catalyst for this turnaround. . This round of financial deleveraging has also brought about a rise in broad-spectrum interest rates, but so far the decline in the scale of social financing has not been obvious. This may be related to the fact that the clean-up and rectification is more concentrated in the “virtual economy†field and the enhancement of the kinetic energy resilience of the real economy. It also shows that the impact of this round of financial de-leveraging on economic activities is expected to be more moderate. Beyond that, there is another issue that needs to be noted that the scale of social financing may not include all the financing channels of the physical sector. For example, since this round of financial deleveraging, brokerage asset management and fund subsidiaries have been greatly affected. The “virtual economy†business has undoubtedly suffered a big impact, but the part of the funds invested in the physical sector may be affected as well, and it is not reflected in the scale of social financing. We can accommodate the funds from various asset management channels to the physical sector, and simply measure the financial system's investment in the social sector. The trend is relatively stable, but there has been a slight decline in the second quarter of this year. There is a certain deviation, so you need to pay attention. Due to the lack of details in the statistics, it is difficult to accurately distinguish which asset management business belongs to the funds invested in the entity, which have statistics in the social integration, which funds have multiple nesting problems, etc., so it is necessary to make more certain conclusions. Still need to wait for the release of more metrics. 4. The decline in foreign exchange holdings narrowed, and the international crude oil price was strong. The exchange rate of the RMB against the US dollar continued to appreciate in August, which was surprising. In hindsight, the continued decline of the US dollar this year, the improvement of China's economic prospects and the significant increase in the interest rate of the asset market caused by financial deleveraging have provided an important fundamental background for the relief of the depreciation of the RMB, which is relatively clear. More specifically, however, the introduction of the central bank's countercyclical adjustment factor in late May seems to constitute a key catalyst. Since then, the renminbi has risen relative to the US dollar, accounting for more than 80% of all the year-to-date gains. The decline in the foreign exchange holdings of the central bank also narrowed month by month. In August, the monthly decline was only 800 million yuan. The net trade settlement and the net sales of capital projects were generally balanced. The exchange rate against the US dollar has deviated from the 7 regions, which has greatly reduced the pressure on central bank regulation. The downward revision of the long-term purchase reserve ratio in mid-September seems to imply the possibility of temporary withdrawal of temporary foreign exchange control measures in the future. The further deepening of the reform of the exchange rate formation mechanism has in fact ushered in a very favorable window. In the short to medium term, the trend of the renminbi still needs to pay attention to the rebound of the US dollar and the staged downside risks of China's economic momentum. However, in the medium and long term, the renminbi may have re-entered the momentum given the prospect of a rebound in China's economic fundamentals. Recently, global industrial metals have been adjusted, but energy prices have remained strong. Cloth oil rose to more than 55 US dollars / barrel, driving the price of US oil to 50 US dollars / barrel, the price difference between the two quickly climbed. Strong energy sources increase the upside risks of agricultural products and food CPI, and need to be vigilant. However, considering the response of the shale oil supply, the kinetic energy of the further increase in oil prices may be gradually constrained, and the time difference constitutes uncertainty. In August, the PMI of the European and Japanese countries fluctuated at a high level, and the US PMI continued to rise. In July, the OECD leading indicators maintained a positive momentum. It seems that the global economic momentum is still stable. In this context, China's recent export deceleration may be limited. Developed and emerging equity markets have remained strong since September, and bond yields have generally fallen. (Gao Shanwen Chief Economist, Anxin Securities, China Director, China Economist Forum) Sina statement: This news is reproduced from the Sina cooperation media, Sina.com posted this article for the purpose of transmitting more information, does not mean agree with its views or confirm its description. Article content is for reference only and does not constitute investment advice. Investors operate on this basis at their own risk. Enter [Sina Finance and Economics Unit] Discussion

This classification includes Christmas sweaters with high quality, good comfort, all kinds of customized colors.

We export to many countries such as Russia, Germany, America etc.

Our products mainly made of cashmere, wool, cotton, acrylic, polyster etc and all the colors, sizes and compositions can be customized.

We also have many cash commodity items, we welcome customers send inquiries and cooperate together.

Christmas Sweater,Christmas Cardigan,Womens Christmas Sweaters,Grinch Christmas Sweater Jiangyin Minglang Textile Co., Ltd , https://www.jymltextile.com